POWER BUSINESS OPERATIONS

Financial Services & Banks

Commercial finance brokers or lenders face a myriad of challenges. If they lose a client to insolvency, it’s a disaster—the broker’s reputation is in tatters and the lender is out of pocket.

Plus, they need to comply with a myriad of AML regulatory requirements. If they don’t, they could face a fine or even prison.

Red Flag Alert’s business intelligence platform helps commercial finance brokers and lenders make better decisions by allowing them to accurately assess each company’s credit and AML risk. It also allows them to increase their revenue by identifying businesses that are most in need of financing.

For business development teams this level of insight can be helpful when preparing pitches for new opportunities. For example, it is invaluable when generating deal flow in the M&A space; being able to advise on acquisition targets in depth can help M&A departments win projects and keep their deal flow high. It is just as effective at enabling the sales team of an insurance broker to segment the market into businesses which have a particular type of risk profile.

Make Better Credit Lending Decisions, Faster

We provide commercial finance lenders and brokers with the following benefits:

- Make decisions faster

- Improve your customer experience

- Increase your revenues

- Avoid bad debt

- Protect your business from regulatory risk

Find the Best Businesses to Lend to

Find businesses that need to borrow

Red Flag Alert provides detailed data on 350 million companies in 163 countries. This can be filtered by over 100 different data points, allowing you to search for companies that are likely to need finance.

Pre-credit check companies

We provide an accurate financial health rating for every UK business. By making these health ratings part of your data filter, you ensure that you only approach financially sound companies.

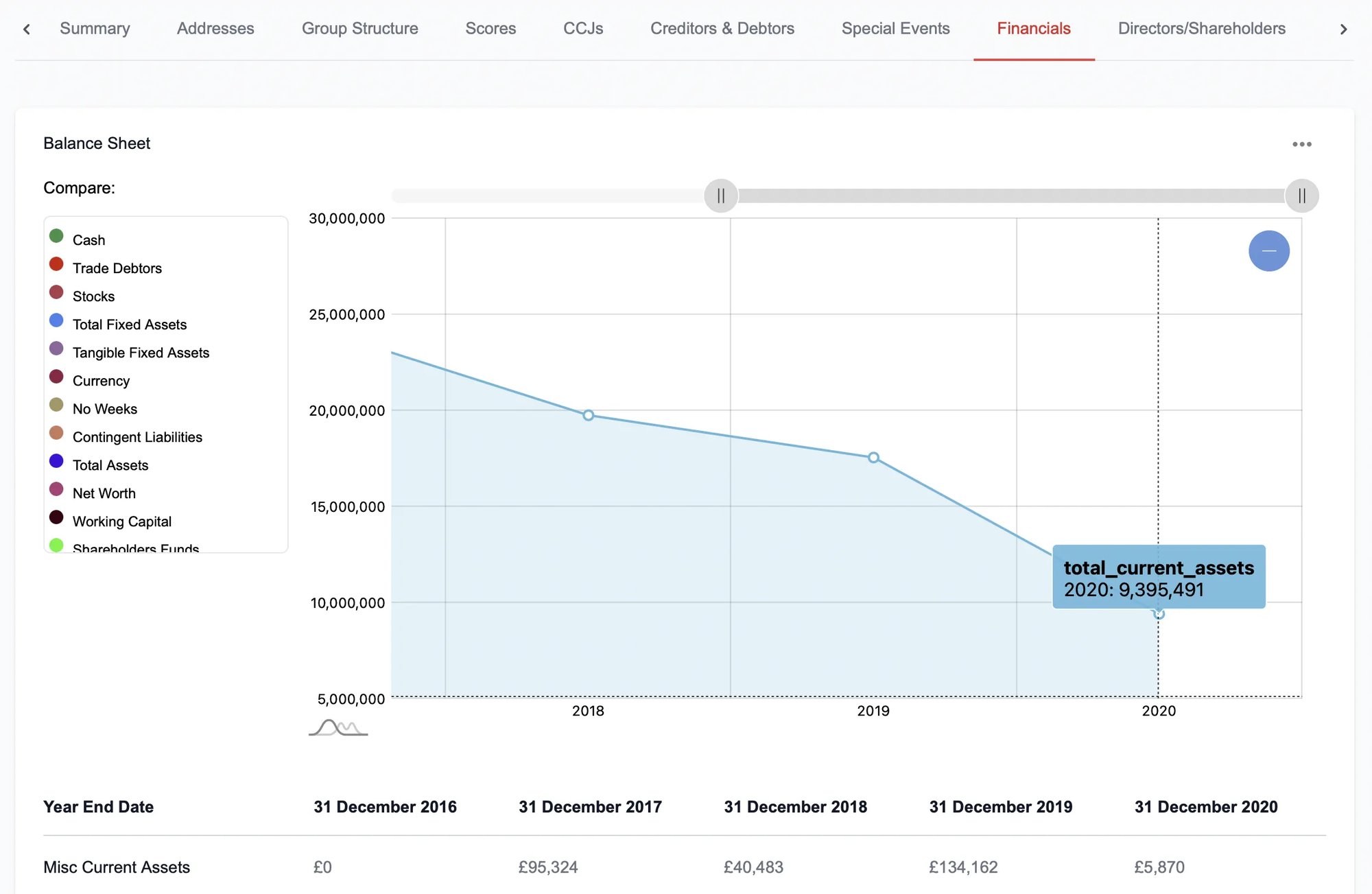

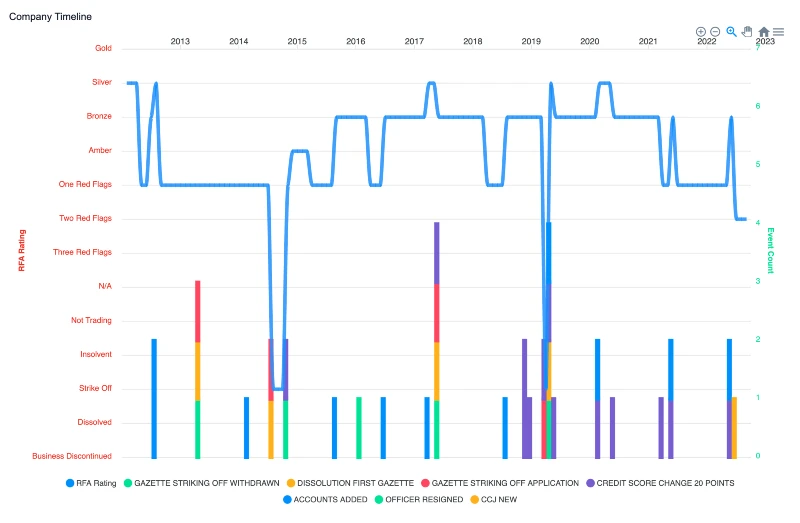

Monitor for financial risk

Our data is updated in real-time, meaning you’ll know if your clients’ financial position starts to deteriorate and giving you time to act.

Manage your portfolio

Our portfolio management tool allows you to monitor the financial health of your customers at a glance and get custom alerts, so you won’t miss insolvency warning signs.

Fast, accurate digital IDV checks

Our self-service digital ID checks allow the customer to verify their identity using their device. It’s fast and convenient, meaning the customer gets their money quicker.

With new economic measures to tackle financial crime being continuously introduced in the UK, your organisation should ensure it's using up-to-date data to manage risk and perform due diligence.

Integrations & Apps with Leading CRMs

Generate even more insights by seamlessly integrating Red Flag with your own CRM. Feed in data to power up your sales and marketing teams so they can work better and more productively.

From Our Customers

Listen to how we have helped our customers

"We were looking for a partner to enhance the data offering to our clients, and Red Flag Alert have done just that. They understood our business, our culture, and our aspirations for the future. We’ve seen some great feedback on our integration, and we are very happy with both the solution and team at Red Flag Alert."

Rob Mead

Strategic Software Projects Director

"We use the search tool to identify businesses in specific geographic areas, with the right number of staff, the right turnover, and a low risk of non-payment. Now we have experienced the benefits of Red Flag Alert, we could not be without it."

Mark Bryan

NSL Telecoms

"From a business development perspective, our brokers are benefiting greatly from the additional information that Red Flag Alert supplies – we’re able to zero in on ideal prospects and build effective marketing lists."

Ben Robert-Shaw

Power Solutions UK

See Why Banks and Financial Organisations Use Red Flag Alert

Financial organisations can utilise Red Flag Alert's data in a number of ways including to find prospects, perform due diligence, stay compliant and reduce risk. Booking a free trial will allow you to discover our full suite of tools available:

- Access to the platform and all the RFA Prospector tools.

- Discover company search & build targeted lists.

- Ongoing support for queries during the trial period

Request a Trial

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Free Company Report

Just looking for a Company Snapshot?

Enter a company name and click Free Report to see:

- Credit Rating

- Accounts

- Key Financials

- Key Contacts