Safeguarding against financial crimes like money laundering is quick, easy, and straightforward with Red Flag Alert.

What is AML?

Anti-money laundering (AML) refers to a set of regulations, laws, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. The main goal of AML measures is to detect and deter activities related to money laundering, terrorism financing, and other financial crimes.

Key components of AML include:

- Customer Due Diligence (CDD)

- Know Your Customer (KYC)

- Transaction Monitoring

- Suspicious Activity Reporting (SAR)

- Compliance Programs

AML regulations are enforced by government agencies and regulatory bodies such as the Financial Action Task Force (FATF) at the international level and various financial regulatory authorities at the national level.

Failure to comply with AML regulations can result in severe penalties, including fines and legal action against the institution and its employees.

What is the Issue with Regular AML Checks

UK businesses must adhere to a complex and evolving regulatory landscape, which involves updating processes to include any changes made to legislation and directives from bodies like FCA.

However, despite these checks ensuring regulatory compliance, they are often exhaustive and require excessive resources and time.

Conducting thorough CDD processes to verify customer identity is also a challenge, beyond the exhaustive resources it requires. For the average person, it is difficult to fully understand the complex corporate structures, international transactions, or PEPs.

To be able to balance compliance with a seamless customer experience is crucial and requires an extensive amount of time, money, training, and knowledge.

This amount of data is incredibly difficult to keep up with, especially for smaller firms that may struggle due to cost and staffing constraints or lack of expertise.

And, as criminals continually adapt money laundering techniques, staying one step ahead of emerging threats requires proactive measures and ongoing monitoring.

Discover how Red Flag Alert has transformed AML processes to ensure regulatory compliance and complete checks with our cutting-edge, digital platform.

How Red Flag Alert’s AML Technology Transforms AML Processes

Fortunately, the team of experts behind Red Flag Alert have revolutionised the process:

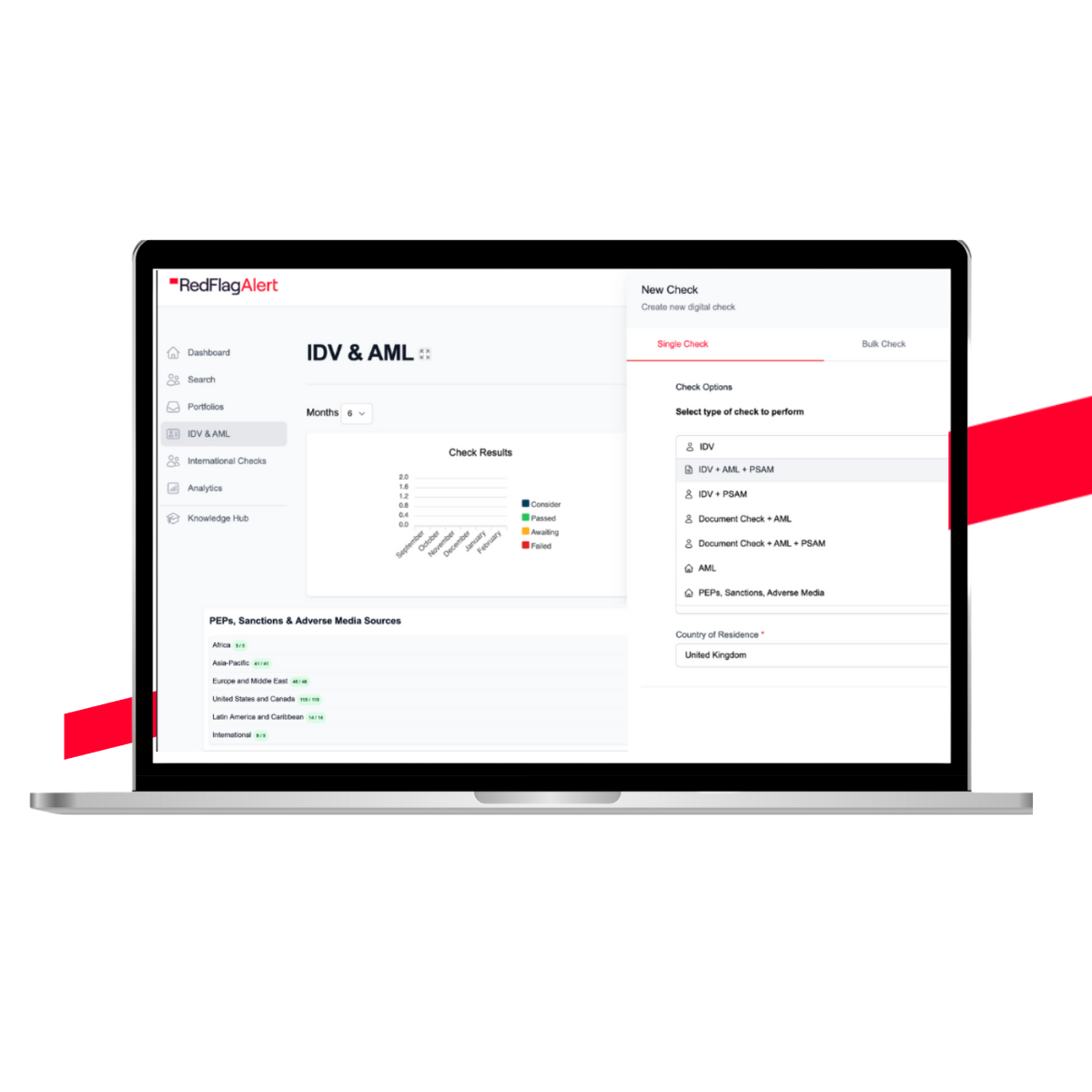

Executing an AML check on RFA's platform is a straightforward process, designed to streamline compliance procedures.

The first step involves understanding your company's specific AML requirements and determining which checks are necessary. While a standard AML check is typically a prerequisite, additional Enhanced Due Diligence (EDD) checks may be necessary, such as screening for adverse media, politically exposed persons (PEPs), and sanctions.

Once the necessary checks are identified, Red Flag Alert users simply input the customer's information and contact details into the platform.

White Labelling

There's also an option to include a personalised message, adding a layer of customisation to the process.

With the information entered, the user initiates the check by clicking "create," prompting RFA's system to send the request directly to the customer.

One of the standout features of the Red Flag Alert platform is its seamless user experience. Customers can complete the AML check from their own devices without downloading additional applications or sending sensitive documents via email.

With Red Flag Alert, users and their customers can enjoy a frictionless process to truly enhance convenience across the compliance process.

Behind the scenes, our multi-bureau system conducts comprehensive checks by cross-referencing the provided information against a plethora of relevant databases and reducing referrals to just 2%.

All of this is completed in a matter of seconds, ensuring thorough due diligence whilst expediting the verification process.

The platform goes one step further, allowing users to conveniently track and manage all ongoing and completed checks within the platform, providing transparency and accountability throughout the compliance journey.

Once the AML check is complete, the detailed report is made available within the RFA platform.

Crucially, all past reports are securely stored within the platform, facilitating easy access for future reference and audit purposes. This not only streamlines record-keeping but also serves as tangible evidence of adherence to AML compliance standards.

Unlock Your Free Trial with Red Flag Alert Today

The work we have done to produce this complete digital platform represents a significant advancement in AML compliance practices.

By simplifying and automating the process, companies can fulfil their regulatory obligations efficiently and effectively.

As regulatory requirements continue to evolve and intensify, leveraging innovative solutions from Red Flag Alert's digital platform is the way to secure your business's future.

By embracing technology-driven approaches to AML compliance, all with the click of a button, use the free AML checker tool and see how we can help your business remain compliant.

%20(1080%20x%201080%20px)-3-2-2.png)

%20(1080%20x%201080%20px)-5-2.webp)

%20(1080%20x%201080%20px)-3-2-1.png)

%20(1080%20x%201080%20px)-2-2.png)